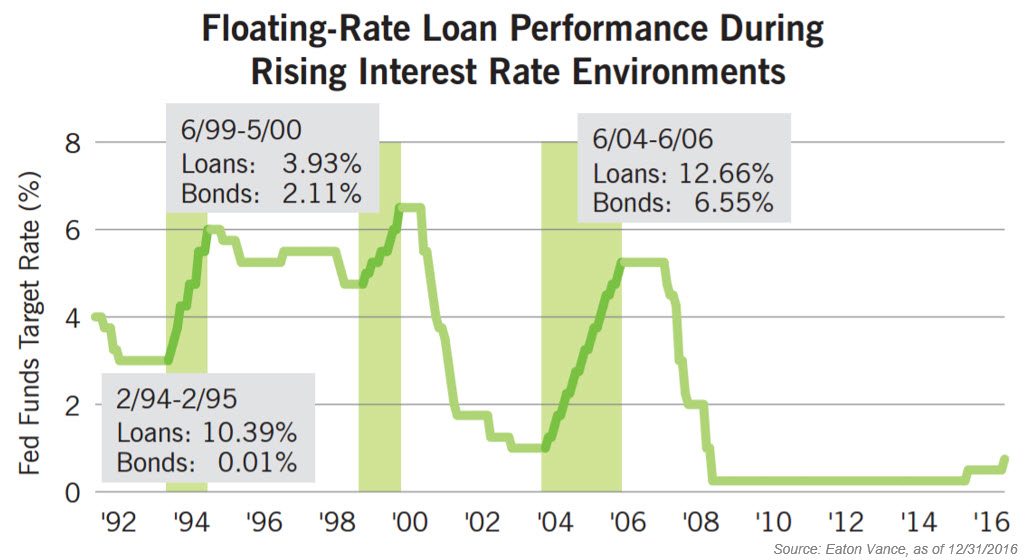

Historically, floating-rate loans outperform the broad bond market in flat- and rising-rate environments. Given that the Fed raised rates in December and with more increases expected in 2017, floating rate bonds can benefit from it.

Floating-rate loans, also called bank loans or leveraged loans, are below-investment grade corporate debts. They are called “floating rate” because their interest rates adjust periodically (30, 60, or 90 days) to reflect the short-term interest rate such as LIBOR (London Interbank Offered Rate) or the federal funds rate plus a fixed spread.

Here are some reasons why floating-rate loans are attractive.

Income source. Floating-rate loans offer an attractive yield with lower volatility compared to junk bonds. Yields typically fall between that of investment-grade and high-yield (junk) bonds to compensate for the credit risk.

Interest rate risk protection. Traditional fixed-rate bonds move inversely to interest rates: when interest rates rise, bond prices fall. In contrast, bank loans move directly, or “float” in accordance with prevailing interest rates. Bank loans also have near-zero duration: the lower the duration, the lesser the sensitivity to interest rate movement. As a result, they can be expected to benefit from rising coupon payments and low interest rate sensitivity.

Senior secured debt. This positioning in the credit structure helps mitigate credit risk. Whereas high-yield bonds are usually unsecured, bank loans are typically secured by the issuer’s assets. Accordingly, loans also rank above equities in a corporation’s capital structure. In case of default, loan investor claims are ahead of high-yield bonds and equity investors. With current economic numbers (e.g. positive GDP growth, positive corporate earnings, improving employment) pointing to positive (although slow) economic growth, perceived credit risk of bank loans is lower.

Inflation protection. Arguably, floating-rate bonds can be used as a diversifier and serve as a hedge not just from rising rates but also inflation due to its positive correlation to TIPS (Treasury Inflation Protected Securities).

Related article: Investment 101: TIPS (Treasury Inflation Protected Securities)