“How can I be a long-term investor if my time horizon is short-term?”

On Wednesday, December 28, 1983, President Ronald Reagan was in the middle of his first term in office and dealing with a terrorist bombing that had occurred in October of that year. The New York Times reported “The President accepted full blame for the lack of security measures that permitted the terrorist bombing of the Marine compound in Beirut¹.” On the same day the largest steel provider in the nation “U.S. Steel announced it was closing three plants in Chicago, Cleveland, Trenton and parts of more than a dozen others elsewhere, eliminating 15,430 jobs².”

In lighter news Barbra Streisand, made the cover of LIFE magazine and it just so happens that this is the day I was born. Maybe these aren’t the most exciting and historical headlines to mark my entry into this world, but some of my favorite and most classic movies were released that year: Risky Business, Scarface, Wargames and Trading Places. Also, I don’t think I could live with myself if I didn’t mention that the video game Mario Bros. was released in Japan in 1983 as well! Lastly, get ready for it…

S&P 500 Opened at 164.6

DJIA Opened at 1,263.92

Nasdaq Opened at 276.57

A lot has happened and changed over the past 38 years. We have had a total of 7 different presidential administrations varying from Republican to Democrat: Reagan, Bush, Clinton, Bush Jr., Obama, Trump and now Biden. On Monday, October 19, 1987, the DJIA dropped more than 20% in a single day, the largest single day drop in history now known as Black Monday. January of 1991 marked the start of the First Gulf War, in 2003 we dealt with SARs, The Great Financial Crisis started on October 7, 2007, and lasted 1022 days from start to recovery. Even today, we are all still adjusting to the life changes of the 2020 COVID pandemic and now we’re right in the middle of what I’m calling “The Great Inflation of 2022.” Despite all the events and changes over time, one truth has remained constant, prudent long-term investors are rewarded.

Let’s take a look at market values as of end of July (7/31/2022):

- The S&P 500 Closed at 4,130.29 this is a total gain of +2,409% since December 28th of 1983, an annual compounded rate of return of 8.85%.

- The DJIA Closed at 32,845.13 up +2,499% or 8.95% per year over that same period.

- The Nasdaq Closed at 12,390.69 which is a whopping +4,380% or 10.52% per year since my birthday 38 years ago!

If my parents had invested $10,000 into an S&P 500 Index Fund the day I was born, and added $250 at the beginning of each month, it would have grown to $1,225,029.32 by end of July 2022. By the way this is despite the fact that we have seen a -22% decline in the S&P 500 this year and are experiencing the worst case of inflation in over 40 years. Also note that this assumes that all dollars are invested the whole time with no attempted day trading or market timing aside from the continued additional investment (buys) each month.

This brings me to The Long-Term Investor Paradox (LTIP) which goes something like this:

I understand the value of being a long-term investor. However,

- “I am about to retire; how can I be a long-term investor if I’m retiring next year?”

- “I am already retired; how can I be a long-term investor if I am already taking withdrawals?”

- “I don’t expect to live more than 5 more years, let alone 10; how can I possibly be a long-term investor?”

If any of these statements sound familiar, then you may be suffering from LTIP. It’s this idea of having too short of a time horizon to be able to think or invest for the long-term. Therein lies the crux of it all, understanding time horizon(s)!

If you find yourself suffering from LTIP, you need to ask yourself: “What is supposed to happen with my savings/investments at the end of my time horizon?” “Do my retirement savings need to be converted to cash immediately?” “How much will I need to withdraw each month to maintain my lifestyle?” How is my estate plan structured: Do I want my heirs to inherit cash or investments?”

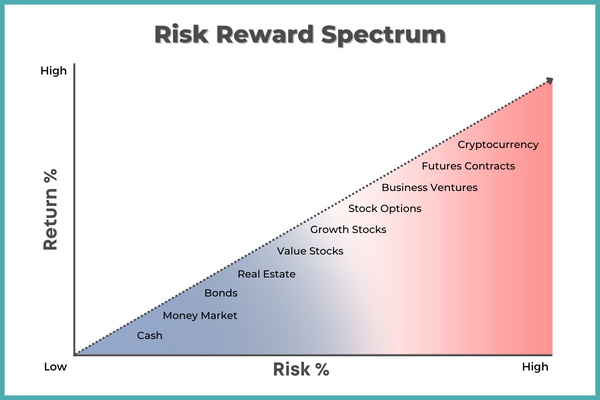

Therefore, the LTIP question should not be “how can I be a long-term investor,” but instead “where can I invest for the long-term given my personal time horizon requirements?” To address this question, we need to discuss the risk / reward spectrum of investing which simply tells us that the higher the amount of risk assumed, the higher the expected return and, likewise, the lower the amount of risk, the lower the expected return.

Note that the risk / reward spectrum can be broken down further into sub-categories which also has its own varying levels of risk. For example, Small Cap, Mid Cap and Large Cap equities all hold different levels of risk and can be incorporated into the risk spectrum under growth & value stocks. Asset Allocation is the position size that we assign in each of these different categories to arrive at an investment allocation across the spectrum that we can confidently hold for the long-term. As my time horizon decreases, generally with age, so does my "high risk exposure" while at the same time I increase my lower risk allocations. Note that this adjustment is regarding our allocation of risk, NOT our allocation to "No Risk" (If such a thing even exists…) In other words, we remain invested for the long-term, the only thing that changes is how much we have invested in each category across the risk and reward spectrum.

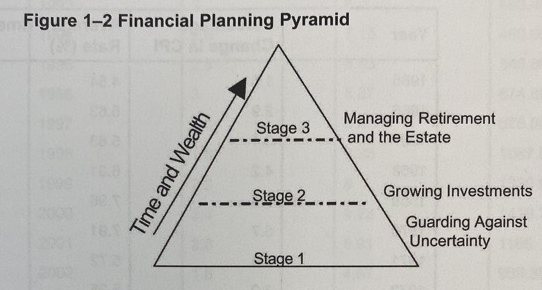

A competent Wealth Manager, Financial Advisor or Financial Planner all understand that risk management is performed during the planning process, not during the actual risk or life event itself. I started in the financial services business over 10 years ago on the insurance side and one of the realities that struck me early on is that most people did not want to purchase insurance until after they needed it, at which point it was too late. There is a reason that risk management is the foundation of financial planning, here is a graphic right out of the Financial Planning textbook, listing "Guarding Against Uncertainty" as Stage 1 of the Financial Planning Pyramid.

All it takes is one major financial event to wipe out a lifetime of hard work. So, when it comes to personal finance you must start with a financial plan, then revisit and update your plan on a regular basis. Note that a young accumulator fresh out of college might only need to update every few years and this would count as regular for them, however a retiree might require an update as often as 1-4 times per year. In the end it is important that we allow the financial plan, not our emotions, to dictate our risk management and asset allocation.

In summary, excluding an immediate upcoming expense such as a new home, college tuition, wedding, etc. we all generally have the capacity to think like long-term investors. If we plan accordingly and adjust our asset allocation to match our time horizon, then our ability to remain invested can hold firm and change the Long-Term Investors Paradox into what I hope is the Long-Term Investors Paradigm.

Source(1)(2): https://www.nytimes.com/1983/12/28/nyregion/wednesday-december-28-1983-international.html

Disclosures:

Advisory services offered by Apriem Advisors (“Apriem”), a registered investment adviser with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that Apriem Advisors or any person associated with Apriem Advisors has achieved a certain level of skill or training. Apriem Advisors may only transact business or render personalized investment advice in those states and international jurisdictions where we are registered, notice filed, or where we qualify for an exemption or exclusion from registration requirements. For complete information about our firm, please refer to our Form ADV Part 2A, 2B and CRS at any time.

All charts and data from Bloomberg unless otherwise indicated.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. Past performance is no guarantee of future results. The reader should not assume that investments in the securities identified were or will be profitable.

Copyright © 2022 Apriem Advisors, All rights reserved.