When I can, I spend a good chunk of my free time listening to financial podcasts or exploring rabbit holes of conversations on Twitter. I learn a lot about topics I otherwise would not have encountered, I learn about terms I otherwise would not know what they mean, and I learn from people with experience who have the wisdom to share. I am also highly fascinated with the psychology of investing, and I think it is absolutely crucial to becoming a great investor. The two topics I discuss here are subjects I’ve taken notes on and have stuck with me, and since the start of 2022, have increasingly felt more relevant.

1.) Selling

There’s the old adage “buy low, sell high”, but if it were that easy, then I would not have a job. And it isn’t that easy, because as with most things in investing, it is easier said than done.

As investors, we all should have a long-term time horizon. And with all due respect, your age is not part of this equation. That is because when placing capital in a company, you should view yourself as a part-owner. As a part-owner, you should be concerned with all aspects of the business so that it can perform well and ultimately return a piece of the performance back to all part-owners. When I buy a company, it is because I think they have great potential (from fundamental research) and excellent management. Great compounders are hard to come across and letting them go is usually a mistake. Also, if you had to predict the long-term outcome for a company over short-term price movements, would you? In other words, it does not make sense to swap a high conviction decision for one with low conviction.

So, when should you sell?

Well, it makes sense to sell when you’re up, right? Locking in and realizing gains is never a bad idea. It is human nature to avoid regret and watch winnings evaporate. Because of this nature, it is desirable to sell assets that have appreciated – after all, a quick glance at the chart and you can see that the price has gone up and it can’t possibly keep going. So, the next most logical thing to do is find another asset that hasn’t appreciated. Right? Suppose you are to argue it is more likely to come down because it has gone up. In that case, you must have never heard of Amazon, Apple, Google, Microsoft, Facebook, AutoZone, Chipotle, Costco… I can keep going. My point is, selling because things are up might not always be the most rational decision.

So, sell when things are down?

No, that’s worse – obviously. Warren Buffet has a famous saying, “sell when others are greedy and buy when others are fearful”. So instead of selling when things are down, I should be buying? In today’s age, trends catch on very quickly, and it is common for retail investors to shift their portfolios around. Consequently, their long-term performance suffers. An example of this comes from a MarketWatch article I dug up that found that only 23% of actively managed funds (ex: Cathie Woods’ ARK) surpassed their passive benchmarks over a ten-year period ending June 2019. Famous investors like Warren Buffet, Howard Marks, and Benjamin Graham know how to take advantage of other investors’ mistakes. This brings me to my next point: default alive.

2.) Default Alive

I first heard this term in a podcast I listen to weekly called, All-In. It felt relatable, and I will explain shortly. Here at Apriem, we pride ourselves on our investment philosophy. We like quality companies with solid management and wide moats (I touched on moats previously in my 1/10/2022 article: read the article here). Why? Well, because these types of companies have the characteristics of a potential compounder, and until the investment thesis no longer holds, the best and hardest thing to do is to be patient and maintain your position.

When I first heard the term “default alive”, it was in reference to the last two corrections U.S. markets have seen. The term was coined by Paul Graham, a programmer, writer, and investor. In short, your company is default dead if you’re losing money because the cost of the business is too great, and value creation comes at the cost of raising capital from investors. When the cost of what you do is less than the revenues you bring in, you are default alive. In short, if the money your business generates isn’t enough to keep your business running without outside help, then you’re in trouble if the market takes an unpleasant turn. The tech crash of the early 2000s was a multi-year recovery that took the NASDAQ nearly 15 years to reach its 2001 high. The market crash of 2008 bottomed in March of 2009 and took the following four years for the DOW to reclaim its prior peak.

If your company was not default alive at the times of these crashes, you quickly learned how important it was to fix your business. And for the investor who chased these trends, as I mentioned prior, your portfolio became a bag of hopes and dreams. That is why we value quality so much when it comes to investing, and never lose sleep over the latest IPO, news cycle, or *fill in the blank*.

To summarize

Investing is not easy, which you know one way or another, but it is not impossible. The underlying theme from what I have written here is that the most important thing in investing – is staying invested. I am not saying selling is bad because there are valid reasons to do so. However, they have nothing to do with the fear of what you cannot predict. Instead, reasons to sell should be based on fundamental factors and not your gut feeling. A good investor has the discipline, skill, and financial know-how on what those reasons should be. Consequently, holding a position down 90% does not make you a genius either. Hence, my emphasis on finding default alive companies.

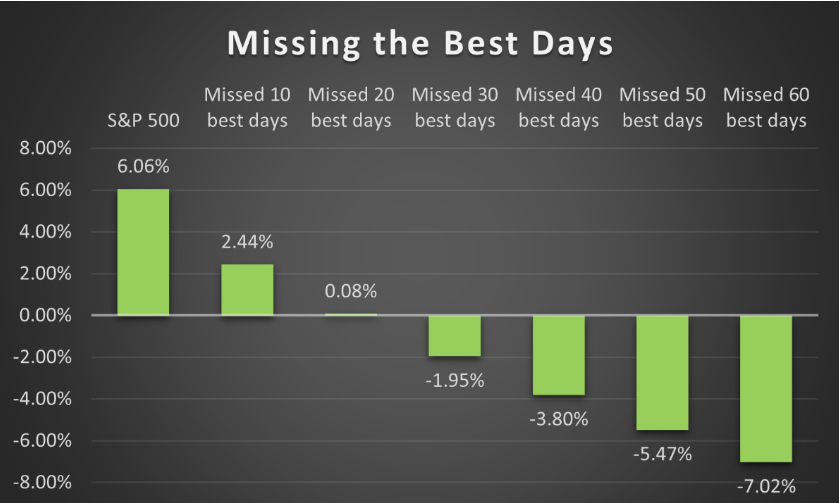

In a Motley Fool article where they cite a JPMorgan study, they found that if you invested $10,000 in the S&P 500 from January 3, 2000, until December 31, 2019, and did not touch a dime, you would have received a return of 6% or see that money grow into $32,421. During these roughly 5000 days, if you missed the ten best days, you would have half as much money as if you were to do nothing. If you missed the best 20 days, you would have made nothing.

S&P 500 returns if you just miss a handful of the best days

At Apriem, we do not day trade, we invest. We take multiple data sources and allocate capital on well-thought-out ideas over a long-term time horizon because the ideal investment is one you never sell. Although I am still new, I do not believe in sacrificing time or quality in an effort to predict markets. Markets can always become turbulent. Tilting our portfolio in well-calculated directions is a strategy we do employ. What we do not employ is converting our portfolio into cash. We are hired to invest systematically, effectively, and reasonably and we must never fail to deliver on our job. There will always be ebbs and flows when investing but missing out on those 10-20 days because we were unable to do what we were hired to do is not the Apriem way.

–Kenneth Wolin

To read the articles or listen to the podcast cited above, use the following links

Motley Fool – https://www.fool.com/investing/2020/12/31/missing-just-a-few-of-the-best-stock-market-days-c/

Market Watch – https://www.marketwatch.com/story/more-evidence-that-passive-fund-management-beats-active-2019-09-12

All-In – https://open.spotify.com/episode/5J3TPXvqDDAid31ft3vqCv

Paul Graham – http://www.paulgraham.com/aord.html